Everywhere you look, crypto businesses seem to be launching their own Layer 2 blockchains.

Worldcoin — the controversial project that's on a mission to scan everyone's irises — is the latest to join the party.

Introducing World Chain, a new blockchain designed for humans ⚪️ pic.twitter.com/qNb7S3vqut

— Worldcoin (@worldcoin) April 17, 2024

Earlier this month, OKX rolled out 'X Layer' its Layer 2 based on Polygon's tech. OKX says its 50 million users will now have easy access to 170 dApps in the Polygon ecosystem through Polygon’s AggLayer.

In November 2023, Kraken announced that it was exploring the launch of its own Layer 2 network. In September 2023, Sony announced its own blockchain plans after investing $3.5 million into Japanese startup Startale Labs. Startale’s founder, who also built the Astar Network, a parachain on the Polkadot network, said the new blockchain could easily surpass Coinbase’s Base blockchain, its Ethereum layer 2 that started this trend.

And Coinbase's L2 — Base — has gone from strength to strength since launching last summer. It's now handling more than 2.7 million transactions a day, driven by a flurry of memecoins as crypto enthusiasts try to get in early on a big gainer.

The concept of Layer 2s, which are typically based on top of the Ethereum blockchain, is pretty easy to understand. Their goal is to relieve congestion on the network and drive down fees by processing transactions externally, then bundling them together for confirmation on the mainnet.

Polygon, Arbitrum and Optimism are some of the earlier L2s that now command multibillion-market caps — but now, it seems centralized exchanges are intent on building their own infrastructure, rather than using what's already out there.

But why?

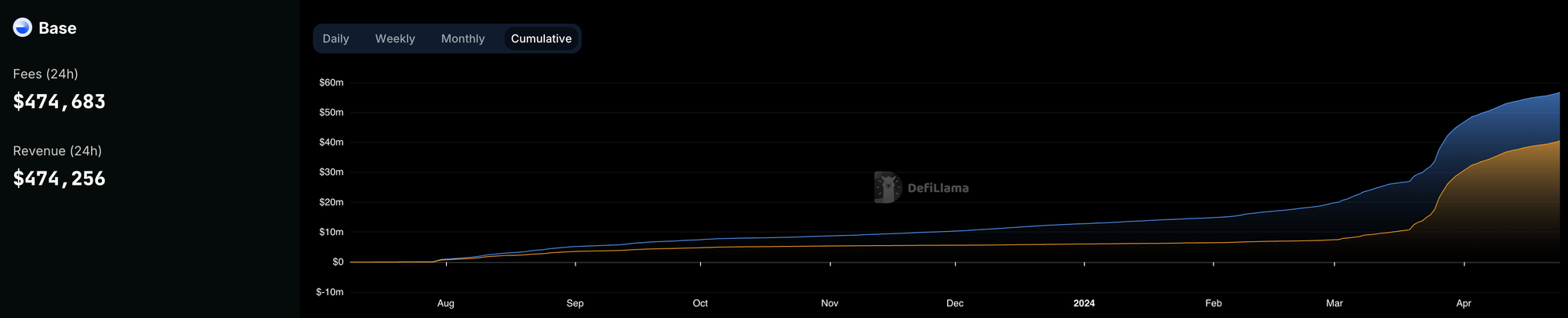

Well, in the long run anyway, Coinbase's L2 could offer much-needed revenue diversification after centralized exchanges entered a race to the bottom on fees. Data from DefiLlama suggests Base has brought in about $500,000 in revenue over the past 24 hours, but this has peaked at close to $4 million when there's frenzied trading activity.

During the whole of last week, revenues stood at $1.76 million — and while this is a substantial fall when compared with the end of March, it remains considerably higher than the start of the year.

Assuming that this weekly revenue of $1.76 million was replicated for a whole year, Base would deliver annual income of $91.5 million for Coinbase. When you consider that the entire exchange's net income for the whole of 2023 stood at $95 million, this doesn't look all that bad.

Of course, the company doesn't dwell on the potential financial upside of Base in its literature for the L2. Instead, it speaks of making it easier for developers to build dApps, increasing decentralization, making crypto transactions cheaper, and further fueling adoption of this still-nascent technology.

In time, Base and other proprietary Layer 2s have the potential to become Web3's answer to Apple's App Store — and we've already seen how that's turned out to be big business for the tech giant, driving $1.1 trillion in sales in 2022.

Within each bull market, mania around new innovations tend to form — with ICOs, NFTs and DeFi all major themes of the past. Looking to 2024, and the race to build L2s seems to be a dominant narrative.